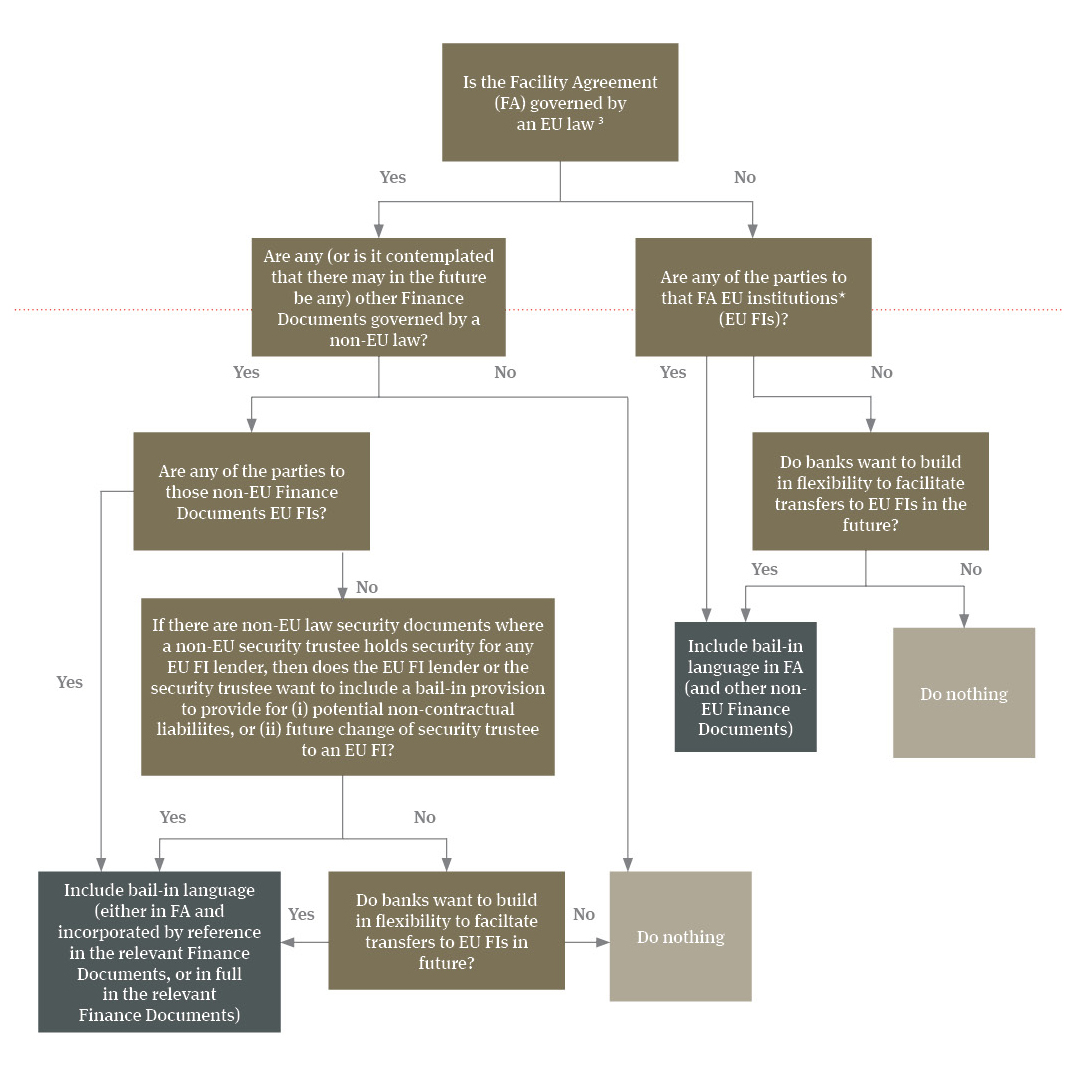

13 November 2020 RECOGNITION OF EU AND UK BAIL-IN CLAUSES FOR OTHER LIABILITIES The purpose of these forms of language is to as

Contractual recognition of bail-in powers by EU-regulated financial institutions from January 2016 | Global law firm | Norton Rose Fulbright

Timeline of the European Banking Union. This figure shows the steps... | Download Scientific Diagram

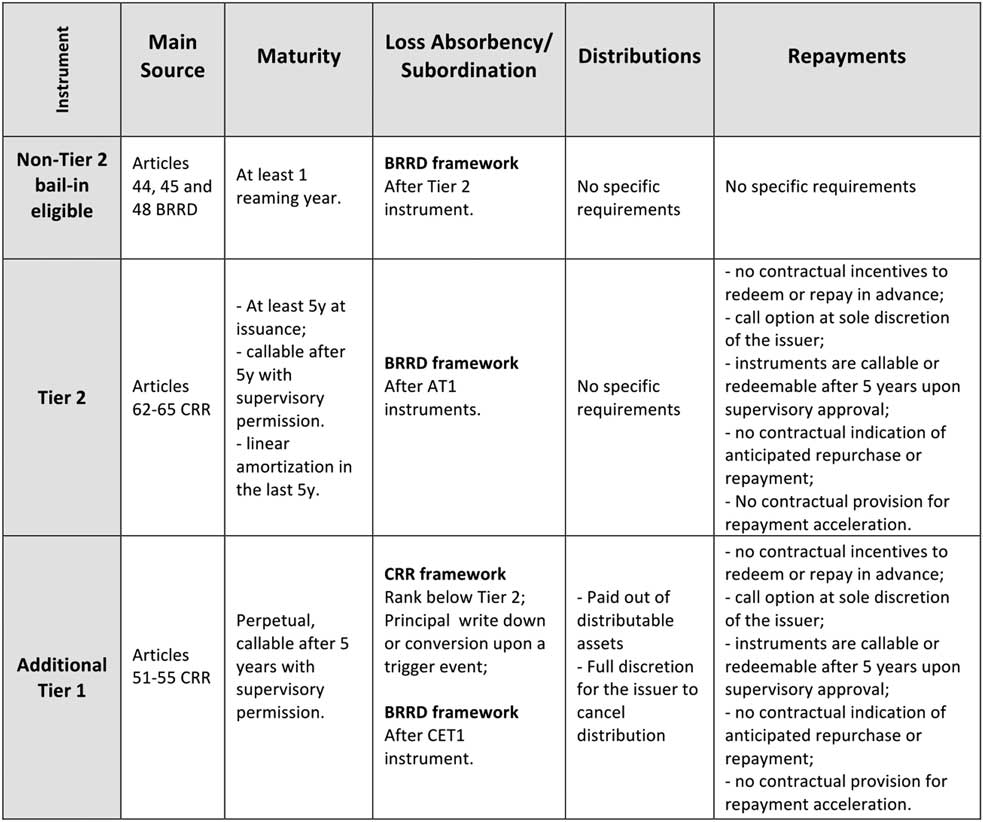

Marco Bigelli on Twitter: "#Bail-In sequence of bank securities under the EU Bank Recovery and Resolution Directive (#BRRD), in force in 2016. https://t.co/sKOrGYKoiH" / Twitter

Bail-inable securities and financial contracting: can contracts discipline bankers? | European Journal of Risk Regulation | Cambridge Core

Debt holder monitoring and implicit guarantees: Did the BRRD improve market discipline? - ScienceDirect